The proliferation of electronic banking necessitates robust systems for tracking and auditing online account activity. This article examines the critical role of audit trails in ensuring online banking security and regulatory compliance.

Effective online banking security relies heavily on comprehensive audit trails. These digital audit trails, meticulously documented in online banking logs, provide a chronological record of all account transactions and user activity. This detailed transaction history is crucial for several reasons. Firstly, it facilitates accurate account reconciliation, ensuring that the bank’s records align precisely with the customer’s. Secondly, it supports proactive fraud detection. By analyzing account activity monitoring data, anomalies suggestive of fraudulent activity can be quickly identified;

Transaction Monitoring and Fraud Prevention

A sophisticated transaction monitoring system continuously scrutinizes online banking features, flagging suspicious patterns. This system plays a vital role in preventing and detecting various forms of financial crime. Regular review of the bank statement, supplemented by detailed online banking logs, allows for early identification of potentially fraudulent transactions.

Regulatory Compliance and Financial Auditing

Maintaining meticulous financial record keeping is paramount for regulatory compliance. Comprehensive audit trails enable financial institutions to meet stringent reporting requirements and demonstrate adherence to relevant regulations. Financial auditing processes greatly benefit from the detailed information provided by these logs. Furthermore, the data facilitates efficient account audit procedures.

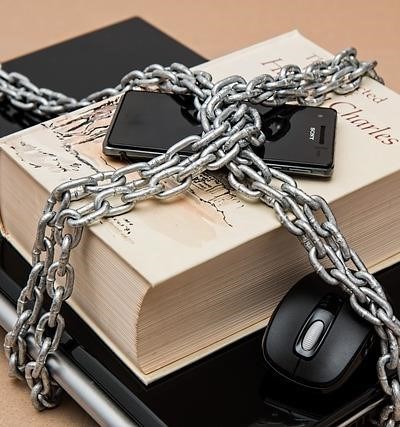

Data Security and Cybersecurity

Protecting the integrity and confidentiality of online banking logs is crucial. Robust data security and cybersecurity measures must be in place to prevent unauthorized access and data breaches. This includes employing encryption, access controls, and regular security audits.

The importance of detailed audit trails in e-banking security cannot be overstated. These trails are essential not only for ensuring the security and integrity of electronic banking transactions but also for meeting regulatory compliance standards and facilitating efficient financial auditing. Proactive account activity monitoring, coupled with robust data security measures, forms the cornerstone of secure and reliable online banking services.

This is a timely and relevant contribution to the literature on online banking security. The clear and concise explanation of the importance of audit trails for various stakeholders, including banks, customers, and regulators, makes this article highly accessible and valuable to a broad audience.

The author effectively highlights the multifaceted importance of audit trails in online banking. The emphasis on both the practical applications, such as account reconciliation and fraud detection, and the regulatory aspects is commendable. The inclusion of data security considerations further strengthens the article’s relevance.

This article provides a comprehensive overview of the critical role of audit trails in maintaining the security and regulatory compliance of online banking systems. The clear articulation of the importance of audit trails in fraud detection and prevention, coupled with the discussion of regulatory compliance, is particularly valuable.

A well-structured and informative piece. The article successfully connects the technical aspects of audit trail implementation with the broader implications for financial security and regulatory compliance. The discussion of transaction monitoring and its role in fraud prevention is particularly insightful.